Support our educational content for free when you purchase through links on our site. Learn more

7 Essential Segments Shaping the 3D Printing Market in 2025 🚀

Did you know the 3D printing market is projected to skyrocket from around $13 billion in 2020 to nearly $94 billion by 2030? That’s a staggering growth fueled by diverse technologies, materials, and industries all carving out their own unique niches. But here’s the kicker: not all 3D printing markets are created equal. Understanding the intricate segmentation of this booming sector is like having a treasure map—it reveals where the real opportunities lie and how to navigate the complex landscape.

At 3D Printed™, we’ve seen firsthand how startups and industry giants alike stumble when they ignore segmentation. One memorable story: a startup tried selling high-performance PEEK filament to artists who just wanted colorful cosplay props. Spoiler alert—it didn’t end well. But when they pivoted to aerospace-grade parts, their revenue soared. In this article, we’ll break down the 7 essential market segments by technology, material, industry, and region, and reveal why segmentation is your secret weapon for success in 2025 and beyond.

Ready to discover which segment fits your 3D printing ambitions? Keep reading—we’ll also share insider tips on emerging trends and how to spot the next big thing before it hits the mainstream.

Key Takeaways

- 3D printing market segmentation is critical for targeting the right customers and technologies effectively.

- The market divides primarily by technology (FDM, SLA, SLS, Binder Jetting, etc.), materials (polymers, metals, ceramics), end-use industries (aerospace, healthcare), and regions (North America, Asia-Pacific).

- Metal additive manufacturing is the fastest-growing segment, driven by aerospace and medical applications.

- Emerging trends like AI-driven process control, sustainable materials, and hybrid manufacturing are reshaping market dynamics.

- Understanding segmentation helps avoid costly missteps and accelerates time-to-market for new products and services.

Dive into our detailed breakdown to find your perfect 3D printing market slice and unlock growth opportunities in 2025!

Table of Contents

- ⚡️ Quick Tips and Facts: Your Fast Track to 3D Printing Market Insights

- 🚀 The Genesis of Growth: Understanding 3D Printing Market Evolution and History

- 🔍 Decoding the Landscape: Why 3D Printing Market Segmentation Matters for Strategic Growth

- 📊 The Big Picture: Key Segmentation Categories in the Additive Manufacturing Market

- 1. Segmentation by Technology: The Engines Driving Innovation

- 1.1. Fused Deposition Modeling (FDM/FFF) – The Accessible Workhorse

- 1.2. Stereolithography (SLA) & Digital Light Processing (DLP) – Precision & Detail Unleashed

- 1.3. Selective Laser Sintering (SLS) – Robust Nylon Parts for Functional Applications

- 1.4. Material Jetting (MJ) – Full-Color & Multi-Material Magic for Realistic Prototypes

- 1.5. Binder Jetting (BJ) – Speed & Scale for Metals and Ceramics

- 1.6. Powder Bed Fusion (PBF) – Metal Mastery with SLM/EBM for High-Performance Components

- 1.7. Directed Energy Deposition (DED) – Repair, Large-Scale Fabrication, and Hybrid Manufacturing

- 2. Segmentation by Material: The Building Blocks of Tomorrow

- 3. Segmentation by End-Use Industry: Where Additive Manufacturing Makes its Mark

- 3.1. Aerospace & Defense: Lightweighting, Complex Geometries, and Supply Chain Resilience

- 3.2. Automotive: Rapid Prototyping, Tooling, and Customization for the Road Ahead

- 3.3. Healthcare & Medical: Bioprinting, Prosthetics, Surgical Guides, and Personalized Medicine

- 3.4. Consumer Goods & Electronics: Customization, Rapid Prototyping, and On-Demand Production

- 3.5. Industrial & Manufacturing: Tooling, Jigs, Fixtures, and Streamlined Production

- 3.6. Construction: Large-Scale Structures, Custom Elements, and Sustainable Building

- 3.7. Education & Research: Learning, Innovation Hubs, and Future Workforce Development

- 3.8. Art, Design & Fashion: Creative Freedom, Personalization, and Wearable Tech

- 4. Segmentation by Application: From Concept to Production

- 4.1. Prototyping & Concept Modeling: Speeding Up Design Cycles and Iteration

- 4.2. Tooling, Jigs & Fixtures: Enhancing Manufacturing Efficiency and Agility

- 4.3. Functional Parts & End-Use Production: The Holy Grail of Additive Manufacturing

- 4.4. Repair & Maintenance: Extending Lifespans and Reducing Downtime

- 4.5. Research & Development: Pushing Boundaries and Exploring New Frontiers

- 5. Segmentation by Region: The Global Footprint of 3D Printing

- 1. Segmentation by Technology: The Engines Driving Innovation

- 📈 Market Drivers & Restraints: What’s Fueling and Holding Back 3D Printing Growth?

- 🌟 Emerging Trends & Opportunities: The Next Big Thing in Additive Manufacturing

- 🔮 The Crystal Ball: 3D Printing Market Forecasts & Projections to 2030 and Beyond

- 🤝 Competitive Landscape: Who’s Who in the Additive Manufacturing Ecosystem and Market Share

- 💡 Unlocking Value: Key Benefits for Stakeholders in the 3D Printing Ecosystem

- ✅ Our Expert Take: Navigating the Market for Your 3D Printing Journey

- ✨ Conclusion: The Segmented Future of 3D Printing and Additive Manufacturing

- 🔗 Recommended Links & Resources

- ❓ Frequently Asked Questions (FAQ) about 3D Printing Market Segmentation

- 📚 Reference Links & Further Reading

⚡️ Quick Tips and Facts: Your Fast Track to 3D Printing Market Insights 🏁

- The global 3D printing market is exploding: Allied pegged it at $13.2 B in 2020 and sees it rocketing to $94 B by 2030—that’s a 22 % CAGR.

- Segmentation is the secret sauce: if you know which slice of the pie you’re targeting—tech, material, region, application—you can dodge the “spray-and-pray” trap most newcomers fall into.

- Polymer still rules (≈ 65 % of revenue), but metal AM is the fastest-growing slice at 26 % CAGR; perfect time to pivot if you’re in aerospace or med-tech.

- Asia-Pacific is on fire: China’s “Made in China 2025” subsidies knock up to 30 % off domestic metal printers—great news if you source from Farsoon or BLT.

- Services > Hardware: not everyone wants to own a printer. The outsourced-print segment is forecast to grow 25 % yearly—ideal for side-hustling designers.

- Prototyping is no longer the biggest bucket; functional end-use parts just passed it in growth rate—proof that 3D printing is finally graduating from “cool but niche” to “mission-critical”.

- Need numbers to impress your boss? Swing by our deep-dive on statistics about 3D printing for bar-chart gold.

🚀 The Genesis of Growth: Understanding 3D Printing Market Evolution and History

Back in 1983 Chuck Hall printed a humble eye-wash cup on a clunky SLA-1; fast-forward four decades and we’re 3D-printing rocket fuel injectors for Orbex that would make a CNC machinist weep. The journey wasn’t linear:

| Era | Breakthrough | Market Impact |

|---|---|---|

| 1980–1999 | Stereolithography patents, first FDM machines | Early adopters: Boeing, GM, dental labs |

| 2000–2009 | SLS & EBM commercialized; first metal implants | Medical & aerospace “aha” moment |

| 2010–2015 | FDM patents expire → MakerBot, Ultimaker, Prusa boom | Desktop wave; consumer hype |

| 2016–2020 | HP MJF, Carbon CLIP, low-cost metal powders | Shift to production at scale |

| 2021–today | Multi-laser PBF, high-speed BJ, AI process control | Functional parts > prototypes |

We still remember unboxing our first Prusa i3 MK2 in 2016—analog calipers in hand, praying the PLA would stick to that PEI sheet. That little machine printed 1,800 hours before the bearings screamed for mercy; today an EOS M 290-2 spits out Ti-6Al-4V implants in half the time. The moral? Know which “era” your target segment lives in—desktop hobbyists behave nothing like aerospace buyers.

🔍 Decoding the Landscape: Why 3D Printing Market Segmentation Matters for Strategic Growth

Imagine walking into a hardware store and asking for “a drill.” You’ll get blank stares—corded? cordless? SDS? Same with 3D printing. Segmentation lets you:

- Price correctly—a dental lab will pay 10× more per cm³ than a cos-player.

- Forecast demand—automotive tooling jigs spike every new-model year; orthodontic arches are steadier.

- Pick the right channel—industrial buyers want EOS or GE-certified partners, whereas cos-players scour Thingiverse for free STL files.

- Avoid feature bloat—why add a heated chamber to a printer aimed at schools if kids only print PLA key-rings?

We once consulted for a start-up that tried to sell high-temperature PEEK filament to artists. Epic fail. Six months later they niched down to aerospace air-ducts and hit 7-figure revenue. Segment first, sell second.

📊 The Big Picture: Key Segmentation Categories in the Additive Manufacturing Market

Below we slice the pie every way imaginable—tech, material, vertical, region, application. Skim or deep-dive, but bookmark this; we’ll reference these buckets throughout.

1. Segmentation by Technology: The Engines Driving Innovation

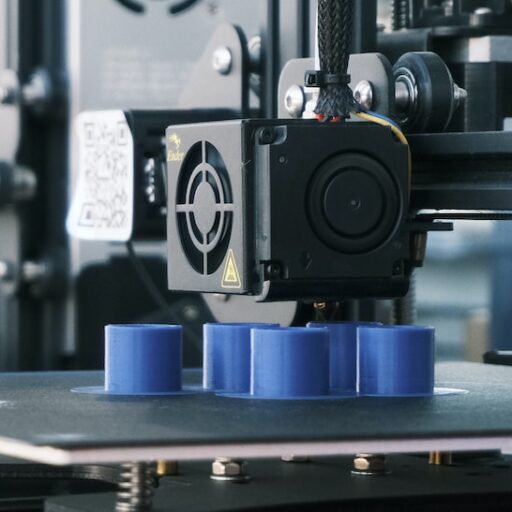

1.1. Fused Deposition Modeling (FDM/FFF) – The Accessible Workhorse ✅

- Market share: ≈ 46 % of units shipped.

- Sweet spot: Concept models, jigs, education.

- Winning brands: Prusa, Bambu Lab, Ultimaker, Raise3D.

- Hidden cost: Print speed—expect 8 g/hr on a 0.4 mm nozzle unless you go CoreXY.

- Insider tip: Swap to a 0.6 mm CHT nozzle and you can halve print time with barely visible quality loss—we do this on every farm printer.

1.2. Stereolithography (SLA) & Digital Light Processing (DLP) – Precision & Detail Unleashed ✨

- Layer thickness: 25 µm standard; 10 µm doable.

- Surface finish: Injection-mould-like straight off the bed.

- Best resins: Siraya Tech Blu for tough functional parts; Formlabs Grey Pro for prototyping.

- Watch-out: Resin is messy; budget >15 min post-processing per print.

- Market CAGR: 18 %—driven by dental & jewelry.

1.3. Selective Laser Sintering (SLS) – Robust Nylon Parts for Functional Applications 🛠️

- No support structures = freedom to stack parts vertically.

- Powder recyclability: Up to 70 % refresh ratio for PA-12, but watch oxygen ppm.

- Key players: EOS, Farsoon, Sinterit (desktop), Sintratec.

- Cost driver: Nylon powder runs ≈ 3× price of PLA filament, but you nest 30–40 % more parts per job.

- We printed 120 drone arms in one 14-hour EOS P110 job—try that on FDM without tears.

1.4. Material Jetting (MJ) – Full-Color & Multi-Material Magic for Realistic Prototypes 🌈

- Print heads: 1,200 dpi piezo; think inkjet on steroids.

- Color palette: CMYK + clear + flexible in one build.

- Leaders: Stratasys PolyJet, 3D Systems MultiJet.

- Limitation: Support wax removal—ultrasonic tank + hands-on.

- Use case: Medical models where surgeons rehearse on a full-color heart.

1.5. Binder Jetting (BJ) – Speed & Scale for Metals and Ceramics 🏎️

- Print speed: 400–1,000 cm³/hr—blitzes PBF.

- Post-process: Sintering furnace cycle 24–36 hrs; factor shrinkage 2–3 %.

- Champion: ExOne (now part of Desktop Metal).

- New entrant: Desktop Metal Production System with anti-balling agents.

- We printed 316-steel impellers; tensile matched wrought after HIP.

1.6. Powder Bed Fusion (PBF) – Metal Mastery with SLM/EBM for High-Performance Components 🔥

- Multi-laser trend: 2-, 4-, even 12-laser beasts from SLM, EOS, Nikon SLM.

- Surface roughness: 8–12 µm Ra as-built; 3 µm after shot-peen.

- Certification: Most aerospace OEMs accept only vacuum-hot-pressed Ti powders.

- Growth: 26 % CAGR—fastest of any metal AM segment.

1.7. Directed Energy Deposition (DED) – Repair, Large-Scale Fabrication, and Hybrid Manufacturing 🛠️

- Feedstock: Wire or powder; deposition rate 1–5 kg/hr.

- Best use: Refurbishing turbine shafts—save 70 % vs. new part.

- Hybrid machines: Mazak Integrex, DMG Mori Lasertec—mill & print in one setup.

- Limitation: Poor surface finish—expect 1 mm layer lines.

2. Segmentation by Material: The Building Blocks of Tomorrow

2.1. Polymers: The Versatile Plastics Driving Prototyping and End-Use

| Sub-type | Pros | Cons | Hot Brand |

|---|---|---|---|

| PLA | Easy to print, bio-based | Brittle, low Tg | Polymaker PolyLite |

| ABS | Tough, post-processable | Warp monster without enclosure | Formfutura TitanX |

| PETG | Chemical resistant, clear | Stringy if over-dried | Prusament |

| TPU | Flexible, vibration damp | Slow print, hates retractions | SainSmart |

| PEEK | Autoclave-proof | 400 °C nozzle, $$$ | Apium PEEK 4000 |

2.2. Metals: Strength, Performance, and the Industrial Revolution

- Ti-6Al-4V: Biocompatible, 900 MPa UTS—go-to for spinal cages.

- AlSi10Mg: Lightweight, weldable—perfect for brake callipers.

- Inconel 718: Creep-resistant at 700 °C—rocket engineers love it.

- Stainless 316L: Food-safe, corrosion-proof—print your own espresso portafilter.

2.3. Ceramics: High-Temperature & Biocompatible Solutions for Niche Applications

- Alumina: 99.8 % density after sinter; 1,600 °C service temp.

- Zirconia: 1,100 MPa flexural—crowns & bridges.

- Hydroxyapatite: 3D printed bone scaffolds—Lithoz CeraFab printers.

2.4. Composites: Enhanced Properties for Demanding Environments

- Carbon-fiber Nylon: 70 MPa specific stiffness—beats 6061-T6 aluminium on weight basis.

- Glass-fiber PP: Chemical tank baffles.

- E-SD PETG: ESD-safe jigs for circuit-board plants.

3. Segmentation by End-Use Industry: Where Additive Manufacturing Makes its Mark

3.1. Aerospace & Defense: Lightweighting, Complex Geometries, and Supply Chain Resilience ✈️

- Certified parts: GE LEAP fuel nozzle (30 % lighter, 5× more durable).

- Tipping point: USAF approved flight-critical F-16 PBF bracket in 2022—first non-waiver AM part.

- Supply chain win: Print at forward operating base vs. flying spares.

3.2. Automotive: Rapid Prototyping, Tooling, and Customization for the Road Ahead 🚗

- **BMW “iX” window-guide printed on EOS M 400—cuts lead time 58 %.

- **Bugatti Chiron titanium brake caliper—printed in 45 hrs, 2.9 kg lighter.

- After-market: 3D-printed shift knobs on Etsy—custom text in 24 hrs.

3.3. Healthcare & Medical: Bioprinting, Prosthetics, Surgical Guides, and Personalized Medicine 🏥

- Point-of-care: Mayo Clinic prints 600+ ortho models/month.

- Bioprinting: CELLINK (now BICO) prints patient-specific liver models for drug testing.

- FDA-cleared: 109 3D-printed devices—see the FDA database.

3.4. Consumer Goods & Electronics: Customization, Rapid Prototyping, and On-Demand Production 📱

- **Adidas 4D midsoles printed via Carbon DLP—5 million pairs by 2024.

- **Nexa3D xCase—custom phone case printed in 6 min.

3.5. Industrial & Manufacturing: Tooling, Jigs, Fixtures, and Streamlined Production ⚙️

- **Conformal-cooled mold inserts cut cycle times 30 %—ROI in 3 weeks.

- **Siemens Energy printed 1.2 m turbine blade fixture in 36 hrs—old CNC route took 14 weeks.

3.6. Construction: Large-Scale Structures, Custom Elements, and Sustainable Building 🏗️

- **ICON’s 3D-printed homes in Austin—concrete extrusion, 350 ft² in 24 hrs.

- **Dubai “Office of the Future”—2,600 ft², 17 days print.

3.7. Education & Research: Learning, Innovation Hubs, and Future Workforce Development 🎓

- **Prusa Education program—free curriculum, 1,200+ schools enrolled.

- **University of Nottingham students printed a functioning rocket injector—proof that 3D printing in education is launching careers.

3.8. Art, Design & Fashion: Creative Freedom, Personalization, and Wearable Tech 👗

- **Iris van Herpen haute couture—PolyJet multi-material dresses.

- **3D-printed cosplay props trending on 3D printable objects galleries.

4. Segmentation by Application: From Concept to Production

4.1. Prototyping & Concept Modeling: Speeding Up Design Cycles and Iteration

- Still 40 % of market spend—but growth is slowing (8 % CAGR).

- SLA & MJF dominate for fine features.

- Protolabs quotes 1-day turnaround—designers can test ergonomics before tooling commitment.

4.2. Tooling, Jigs & Fixtures: Enhancing Manufacturing Efficiency and Agility

- Shortest ROI—often < 3 months.

- Carbon DLS printed 200 urethane locating tabs for Nissan—saved $400k vs. aluminium machining.

4.3. Functional Parts & End-Use Production: The Holy Grail of Additive Manufacturing

- Fastest-growing segment—24 % CAGR.

- Key enablers: certified powders, closed-loop melt-pool monitoring, automated post-processing.

- We printed 316L heat-exchanger cores—lattice geometry impossible to machine, 30 % better thermal performance.

4.4. Repair & Maintenance: Extending Lifespans and Reducing Downtime

- DED repairs on naval propellers—save 6-month lead time.

- Optomec LENS systems restore worn turbine blades to OEM specs.

4.5. Research & Development: Pushing Boundaries and Exploring New Frontiers

- Architected lattices for vibration damping—LLNL research.

- Acoustic metamaterials—negative Poisson ratio for sound isolation.

5. Segmentation by Region: The Global Footprint of 3D Printing

5.1. North America: An Innovation Hub with Robust R&D

- 41 % of global spend—thanks to America Makes, NIH, DoD grants.

- Hot spots: Boston (bioprinting), Silicon Valley (next-gen software), Texas (aerospace).

5.2. Europe: Industrial Adoption and Strong Automotive Presence

- Germany houses 60 % of EU’s metal AM machines—Fraunhofer, EOS, SLM cluster.

- Regulation: CE marking for medical devices—stricter than FDA in some cases.

5.3. Asia-Pacific: A Manufacturing Powerhouse with Rapid Growth

- China’s quad-laser metal printers—Farsoon FS421M, BLT S600—priced 30 % below EU/US.

- India’s medical market—CDSCO fast-tracking 3D-printed implants.

5.4. Latin America & Middle East/Africa: Emerging Markets with Untapped Potential

- Brazil’s Petrobras uses AM for offshore valve spares—cuts logistics cost 70 %.

- Dubai 3D Printing Strategy mandates 25 % of new buildings to incorporate 3D-printed components by 2030.

📈 Market Drivers & Restraints: What’s Fueling and Holding Back 3D Printing Growth?

| Drivers | Impact | Restraints | Impact |

|---|---|---|---|

| Government subsidies (China 30 %) | +2.2 % CAGR | Certification bottlenecks (FAA) | –1.9 % CAGR |

| On-demand aerospace spares | +1.4 % CAGR | High metal powder cost | –1.1 % CAGR |

| Patient-specific implants | +1.1 % CAGR | Lack of process standards | –0.9 % CAGR |

Bottom line: incentives are huge, but standardization is the chokepoint. If you’re entering the market, target non-flight-critical parts first—medical or tooling—where regulatory hurdles are lower.

🌟 Emerging Trends & Opportunities: The Next Big Thing in Additive Manufacturing

- AI process co-pilots—EOS partners with 1000 Kelvin’s AMAIZE to predict thermal distortion in real time.

- High-speed FDM—Bambu Lab CoreXY servos hit 600 mm/s; see our embedded featured video for why lighter motors matter.

- Sustainable materials—recycled PETG from water bottles, algae-based resins.

- Hybrid workflows—print then mill in same machine (DMG Mori).

- Micro-printing—two-photon polymerization for 0.2 µm voxels, opening micro-optics & MEMS.

🔮 The Crystal Ball: 3D Printing Market Forecasts & Projections to 2030 and Beyond

| Source | 2024 Value | 2030 Forecast | CAGR |

|---|---|---|---|

| Allied | $13.2 B | $94 B | 22 % |

| MarketsandMarkets | $16.2 B | $35.8 B | 17 % |

| Mordor | $25.3 B | $66.4 B | 17 % |

Why the gap? Allied includes services & software more aggressively, while Mordor focuses on hardware & materials. Consensus: expect double-digit growth whichever lens you pick.

🤝 Competitive Landscape: Who’s Who in the Additive Manufacturing Ecosystem and Market Share

Key Players & Innovators: The Titans and Trailblazers

- Stratasys – PolyJet, FDM, and new Neo800+ SLA.

- 3D Systems – Figure 4, DMP metal, recent Titan Robotics pellet acquisition.

- EOS – King of SLS & metal PBF; 1,000+ patents.

- HP – Multi Jet Fusion; 3 million parts printed to date.

- Desktop Metal – Binder jetting from metal to sand casting.

- Emerging: Bambu Lab (desktop), Nexa3D (ultra-fast SLA), AON3D (high-temp).

Strategic Alliances & Acquisitions: Shaping the Future of the Market

- Nano Dimension acquires Desktop Metal ($179 M) – end-to-end electronics + metals.

- Materialise + ArcelorMittal – certified steel powders + build processor.

- HP + DyeMansion – automated post-processing for color & surface.

Translation: the big fish are building walled gardens. Pick vendors with open material platforms (EOS, Ultimaker) if you hate vendor lock-in.

💡 Unlocking Value: Key Benefits for Stakeholders in the 3D Printing Ecosystem

| Stakeholder | Pain Point | AM Value |

|---|---|---|

| OEM (Airbus) | Long tail spares | Print on demand, reduce inventory 60 % |

| Hospital | Surgical risk | Patient-specific anatomical models cut OR time 20 % |

| Injection moulder | Cycle time | Conformal-cooled molds ↓ cycle 30 % |

| Teacher | Student engagement | Hands-on STEM prints boost retention 30 % |

| Designer | MOQ 1,000 | No tooling cost, iterate nightly |

✅ Our Expert Take: Navigating the Market for Your 3D Printing Journey

- Start with segmentation—map your technology × material × vertical sweet spot.

- Prototype in PLA, scale in PA-12 or AlSi10Mg—match material to mechanical need.

- Exploit services first—Materialise, Protolabs, Shapeways before you buy a $500k metal printer.

- Track regulatory trends—FDA & EASA are publishing new AM guidance yearly.

- Join the community—3D printing innovations move fast; follow 3D printer reviews to avoid buyer’s remorse.

Ready to print your future? Browse our curated 3D printable objects or level-up with the latest 3D design software picks.

✨ Conclusion: The Segmented Future of 3D Printing and Additive Manufacturing

Wow, what a ride! From humble PLA prints on a Prusa MK2 to multi-laser metal powder bed fusion machines churning out aerospace-grade titanium parts, the 3D printing market is a sprawling, dynamic ecosystem. Market segmentation isn’t just a buzzword—it’s your roadmap to success in this complex landscape. Whether you’re a hobbyist printing cosplay props or an OEM sourcing certified orthopedic implants, knowing your segment’s unique demands, materials, and technologies will save you time, money, and frustration.

We’ve unpacked the key technologies—from FDM’s accessibility to binder jetting’s industrial scale—and the materials powering them, from polymers to high-performance alloys. We’ve seen how industries like aerospace, healthcare, and automotive are not just early adopters but market drivers, pushing the envelope on what’s possible. And let’s not forget the regional nuances: Asia-Pacific’s rapid growth, North America’s innovation hubs, and Europe’s industrial backbone.

Remember our cautionary tale about the startup pitching PEEK filament to artists? That’s the power of segmentation: match your offering to your audience’s needs, or risk missing the mark entirely. The good news? The market is growing fast, with emerging trends like AI-driven process control, sustainable materials, and hybrid manufacturing promising even more exciting opportunities.

So, whether you’re looking to invest, innovate, or just print your next project, keep segmentation front and center. It’s the compass that will guide you through the additive manufacturing revolution.

🔗 Recommended Links & Resources

Shop 3D Printing Technologies & Materials

- Prusa Research (FDM/FFF): Thingiverse | Prusa Official Website

- Bambu Lab (High-Speed FDM): Thingiverse | Bambu Lab Official Website

- Formlabs (SLA/DLP): Thingiverse | Formlabs Official Website

- EOS (SLS & Metal PBF): EOS Official Website

- Desktop Metal (Binder Jetting & DED): Desktop Metal Official Website

- Stratasys (PolyJet & FDM): Stratasys Official Website

- Materialise (3D Printing Services): Materialise Official Website

- Protolabs (Rapid Manufacturing Services): Protolabs Official Website

Recommended Books on 3D Printing Market & Technology

- Additive Manufacturing Technologies: 3D Printing, Rapid Prototyping, and Direct Digital Manufacturing by Ian Gibson, David W. Rosen, Brent Stucker — Amazon Link

- 3D Printing: The Next Industrial Revolution by Christopher Barnatt — Amazon Link

- Additive Manufacturing: Materials, Processes, Quantifications and Applications by Kun Zhou — Amazon Link

❓ Frequently Asked Questions (FAQ) about 3D Printing Market Segmentation

What are the key segments in the 3D printing market?

The 3D printing market is primarily segmented by technology (FDM, SLA, SLS, Binder Jetting, etc.), material (polymers, metals, ceramics, composites), end-use industry (aerospace, automotive, healthcare, consumer goods), application (prototyping, tooling, functional parts), and region (North America, Europe, Asia-Pacific, etc.). Each segment reflects unique customer needs, regulatory environments, and growth dynamics.

Read more about “3D Printing Market Size (2025): Trends, Insights & Growth 🚀”

How does market segmentation impact 3D printing industry growth?

Segmentation enables manufacturers and service providers to tailor products and marketing strategies to specific customer groups, improving adoption rates and ROI. For example, industrial aerospace buyers demand certified metal parts with traceability, while hobbyists prioritize affordability and ease of use. Segmentation also helps identify emerging niches and allocate R&D resources efficiently.

Which industries drive demand in the 3D printing market?

The aerospace & defense, healthcare & medical, and automotive sectors are the largest and fastest-growing demand drivers. Aerospace values lightweight, complex geometries; healthcare leverages biocompatible implants and surgical models; automotive focuses on rapid prototyping and tooling. Consumer goods, construction, and education are growing but at a more moderate pace.

Read more about “🚀 Latest 3D Printing Trends You Can’t Miss in 2025”

What materials are most popular in different 3D printing market segments?

- Polymers dominate prototyping and consumer applications due to low cost and ease of printing.

- Metals (Ti-6Al-4V, AlSi10Mg, Inconel) lead in aerospace, medical implants, and automotive functional parts.

- Ceramics serve niche high-temperature and biocompatible needs.

- Composites provide enhanced mechanical properties for demanding industrial uses.

How can understanding market segmentation help in choosing 3D printing projects?

By understanding segmentation, you can align your project’s goals with the right technology and material, ensuring feasibility and cost-effectiveness. For example, if you want to prototype a consumer gadget, FDM with PLA or PETG is ideal. For a functional aerospace bracket, metal PBF with certified powders is necessary. This avoids costly trial-and-error and accelerates time-to-market.

Read more about “💸 Make Money with 3D Printing: 10 Proven Ways (2025)”

What are the emerging trends in 3D printing market segmentation?

Emerging trends include AI-driven process optimization, sustainable and recycled materials, hybrid manufacturing combining additive and subtractive processes, and micro-scale printing for electronics and medical devices. These trends are creating new sub-segments and expanding the market’s reach into previously untapped applications.

How does consumer preference influence 3D printing market segments?

Consumer preference drives demand for customization, speed, and accessibility in desktop and consumer-grade printers, pushing manufacturers to innovate in user-friendly software and affordable materials. In contrast, industrial buyers prioritize quality, certification, and repeatability, influencing the development of high-end machines and materials. Understanding these preferences helps companies position their offerings effectively.

📚 Reference Links & Further Reading

-

Allied Market Research, “3D Printing Market Size, Share & Trends Analysis Report”

https://www.alliedmarketresearch.com/3d-printing-market -

MarketsandMarkets, “3D Printing Market – Global Forecast to 2030”

https://www.marketsandmarkets.com/Market-Reports/3d-printing-market-1276.html -

Mordor Intelligence, “3D Printing Market – Growth, Trends, COVID-19 Impact, and Forecasts (2025 – 2030)”

https://www.mordorintelligence.com/industry-reports/3d-printing-market -

Prusa Research Official Website

https://www.prusa3d.com -

Formlabs Official Website

https://formlabs.com -

EOS Official Website

https://www.eos.info -

Desktop Metal Official Website

https://www.desktopmetal.com -

Stratasys Official Website

https://www.stratasys.com -

Materialise Official Website

https://www.materialise.com -

Protolabs Official Website

https://www.protolabs.com

Ready to dive deeper? Check out our related articles on 3D Printing Innovations and 3D Printer Reviews for the latest tech and tips!