Support our educational content for free when you purchase through links on our site. Learn more

Unveiling the 3D Printing Market Share by Company: Top Players to Watch in 2025 🚀

As the world of 3D printing continues to evolve at a breakneck pace, understanding the market share by company is crucial for anyone looking to navigate this dynamic landscape. With projections indicating a staggering growth trajectory—expected to reach USD 101.74 billion by 2032—the stakes have never been higher. But who are the key players driving this revolution? In this article, we’ll dive deep into the top companies shaping the future of 3D printing, exploring their strengths, market positions, and innovative technologies.

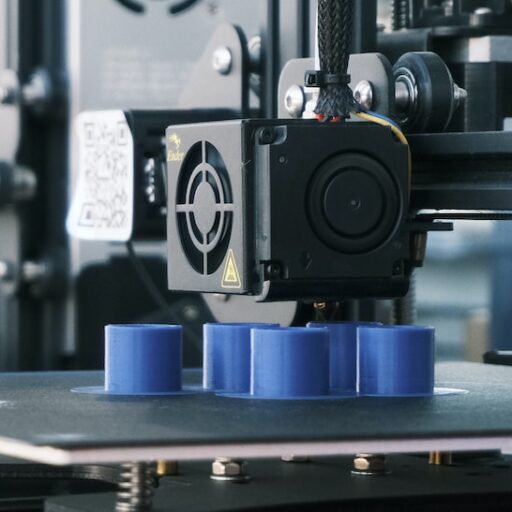

Did you know that 71% of businesses utilizing 3D printing rely on Fused Deposition Modeling (FDM)? This technology is just one of the many fascinating aspects we’ll uncover as we analyze the competitive landscape. Whether you’re a hobbyist, an entrepreneur, or an industry veteran, this comprehensive guide will equip you with the insights you need to make informed decisions in the 3D printing arena.

Key Takeaways

- The 3D printing market is projected to grow to USD 101.74 billion by 2032, with a CAGR of 23.4%.

- Key players such as Stratasys, 3D Systems, and GE Additive dominate the market, each with unique strengths and technologies.

- Emerging trends like bioprinting, 4D printing, and sustainable practices are reshaping the industry landscape.

- Understanding the market dynamics and regional insights is essential for identifying opportunities and challenges.

- 👉 Shop top brands like Stratasys and 3D Systems to explore cutting-edge 3D printing solutions.

Ready to dive in? Let’s explore the fascinating world of 3D printing and discover what the future holds!

Table of Contents

Quick Tips and Facts

The Evolution of 3D Printing: A Market Journey

3D Printing Market Overview: Size, Share, and Growth

Market Dynamics: Drivers, Challenges, and Opportunities

Emerging Trends in 3D Printing: What’s Hot?

In-Depth Segmentation Analysis: Breaking Down the Market

Regional Insights: 3D Printing Market by Geography

Competitive Landscape: Key Players and Their Market Share

Recent Innovations and Key Industry Developments

Understanding the Report Coverage: What You Need to Know

Scope & Segmentation of the 3D Printing Market

Frequently Asked Questions: Your 3D Printing Queries Answered

Conclusion: The Future of 3D Printing Market Share

Recommended Links for Further Reading

FAQ: Your 3D Printing Questions

Reference Links: Sources and Further Information

Quick Tips and Facts

- 🤯 The global 3D printing market is booming! It’s projected to skyrocket to a whopping USD 101.74 billion by 2032, according to Fortune Business Insights. That’s a CAGR of 23.4%! Clearly, 3D printing is no longer a futuristic fantasy – it’s here, it’s growing, and it’s transforming industries.

- 🚀 North America is leading the charge. In 2024, it dominated the market with a 41.39% share. But don’t underestimate the Asia Pacific region – it’s hot on North America’s heels and expected to grow at the fastest rate.

- 💰 Want to invest in 3D printing? Keep an eye on companies like Stratasys, 3D Systems, and GE Additive. They’re the heavy hitters in this industry.

- 🤔 Think 3D printing is just for prototypes? Think again! While prototyping is a major application, 3D printing is increasingly used for manufacturing functional parts, from aerospace components to medical implants.

- 💡 Did you know? 71% of businesses using 3D printing rely on Fused Deposition Modeling (FDM) technology. It’s the most popular choice due to its ease of use and affordability.

Want to explore the fascinating world of 3D printing further? Check out our articles on 3D Printable Objects and 3D Printing Innovations.

The Evolution of 3D Printing: A Market Journey

The journey of 3D printing, also known as additive manufacturing, has been nothing short of remarkable. From its humble beginnings as a niche technology used primarily for prototyping, 3D printing has evolved into a transformative force across numerous industries. Let’s take a trip down memory lane and explore the key milestones that have shaped the 3D printing market:

Early Days: The Genesis of Additive Manufacturing (1980s)

- The 1980s witnessed the birth of 3D printing with the invention of stereolithography (SLA) by Chuck Hull. This groundbreaking technology used UV lasers to solidify liquid polymers, laying the foundation for what we know as 3D printing today.

Gaining Traction: Prototyping and Early Adoption (1990s)

- The 1990s saw 3D printing gain traction as a viable prototyping tool. Industries like automotive and aerospace began to recognize its potential for creating rapid prototypes, reducing lead times, and accelerating product development cycles.

The Rise of FDM and Desktop 3D Printing (2000s)

- The 2000s marked a turning point with the emergence of Fused Deposition Modeling (FDM). This technology, pioneered by Stratasys, made 3D printing more accessible and affordable, leading to the rise of desktop 3D printers. The maker movement embraced this technology, fueling innovation and creativity at the grassroots level.

Mainstream Adoption and Industry 4.0 (2010s – Present)

- The past decade has witnessed the widespread adoption of 3D printing across industries. From healthcare to manufacturing, businesses are leveraging 3D printing for a wide range of applications, including:

- Personalized medicine: Creating custom-designed implants, prosthetics, and medical devices tailored to individual patient needs.

- Aerospace: Manufacturing lightweight and complex components for aircraft, reducing weight and improving fuel efficiency.

- Automotive: Producing customized car parts, enabling mass personalization and on-demand manufacturing.

The Future of 3D Printing: Limitless Possibilities

The future of 3D printing is brimming with possibilities. As technology continues to advance, we can expect to see:

- New Materials: The development of innovative materials with enhanced properties, expanding the applications of 3D printing even further.

- Increased Automation: Integration of artificial intelligence (AI) and machine learning (ML) to optimize 3D printing processes, making them more efficient and cost-effective.

- Mass Customization: 3D printing will empower businesses to offer highly personalized products, catering to individual customer preferences.

The journey of 3D printing is a testament to human ingenuity and the relentless pursuit of innovation. As we venture further into the 21st century, 3D printing is poised to revolutionize the way we design, manufacture, and interact with the world around us.

3D Printing Market Overview: Size, Share, and Growth

The 3D printing market is experiencing phenomenal growth, driven by factors such as:

- Rapid technological advancements: The continuous development of new 3D printing technologies, materials, and software is expanding the capabilities and applications of 3D printing.

- Increasing adoption across industries: From automotive to healthcare, industries are increasingly integrating 3D printing into their workflows for prototyping, tooling, and even end-use part production.

- Government initiatives and investments: Governments worldwide are recognizing the transformative potential of 3D printing and are investing in research and development initiatives to foster its growth.

Here’s a glimpse into the current market landscape:

- Market Size: The global 3D printing market was valued at USD 19.33 billion in 2024 and is projected to reach USD 101.74 billion by 2032, growing at a CAGR of 23.4% (Source: Fortune Business Insights).

- Key Players: The market is dominated by key players such as Stratasys, 3D Systems, GE Additive, HP Inc., and EOS. These companies are constantly innovating and expanding their product portfolios to maintain their competitive edge.

- Regional Dominance: North America currently holds the largest market share, followed by Europe and Asia Pacific. However, the Asia Pacific region is expected to witness the fastest growth in the coming years due to increasing industrialization and adoption of advanced technologies.

Market Dynamics: Drivers, Challenges, and Opportunities

Drivers 🚀

- Accelerated Product Development Cycles: 3D printing enables rapid prototyping, allowing manufacturers to test and iterate designs quickly, significantly reducing lead times.

- Cost-Effectiveness for Customization: 3D printing makes it economically viable to produce customized products, even in small batches, catering to the growing demand for personalization.

- Manufacturing Complex Geometries: 3D printing can create intricate and complex designs that are impossible to manufacture using traditional methods, opening up new design possibilities.

- On-Demand Manufacturing: 3D printing facilitates on-demand manufacturing, reducing the need for large inventories and enabling businesses to respond quickly to changing market demands.

Challenges 🚧

- Limited Material Selection: The range of materials compatible with 3D printing is still limited compared to traditional manufacturing processes, restricting some applications.

- Scalability and Mass Production: While 3D printing excels in prototyping and small-batch production, scaling up to mass production levels can be challenging and costly.

- High Initial Investment Costs: The initial investment costs for 3D printers, materials, and software can be significant, posing a barrier to entry for some businesses, especially startups and SMEs.

- Lack of Skilled Workforce: There is a shortage of skilled labor with expertise in 3D printing technologies, hindering wider adoption.

Opportunities ✨

- Expansion into New Markets: 3D printing has the potential to revolutionize industries beyond manufacturing, such as healthcare, construction, and even food production.

- Development of New Materials: Research and development of new 3D printing materials with enhanced properties will unlock new applications and drive market growth.

- Integration with Industry 4.0: Integrating 3D printing with other Industry 4.0 technologies, such as AI, ML, and the Internet of Things (IoT), will lead to smarter and more efficient manufacturing processes.

- Sustainable Manufacturing: 3D printing can contribute to more sustainable manufacturing practices by reducing waste, minimizing material consumption, and enabling localized production.

Emerging Trends in 3D Printing: What’s Hot? 🔥

The 3D printing landscape is constantly evolving, with new trends emerging all the time. Here are some of the hottest trends shaping the future of 3D printing:

- Generative Design and AI-Powered Optimization: Generative design algorithms, powered by AI, are revolutionizing the design process. By inputting design goals and constraints, engineers can leverage AI to generate optimized designs that would be impossible to conceive using traditional methods. This not only accelerates the design process but also results in lighter, stronger, and more efficient structures.

- Metal 3D Printing for End-Use Parts: Metal 3D printing, also known as additive manufacturing of metals, is gaining significant traction in industries such as aerospace, automotive, and medical. The ability to create complex metal parts with high precision and strength is driving the adoption of metal 3D printing for end-use part production.

- Bioprinting and 3D Printed Organs: Bioprinting, a specialized field of 3D printing, is pushing the boundaries of medicine. Researchers are making remarkable progress in bioprinting tissues and organs, offering hope for organ transplantation and regenerative medicine.

- 4D Printing: Shapeshifting Materials: 4D printing takes 3D printing to the next level by incorporating materials that can change shape or properties over time in response to external stimuli, such as heat, light, or moisture. This opens up exciting possibilities for creating adaptive and responsive products.

- Sustainable 3D Printing Practices: As sustainability becomes increasingly important, the 3D printing industry is focusing on developing eco-friendly materials and processes. This includes using recycled materials, reducing waste, and minimizing energy consumption.

In-Depth Segmentation Analysis: Breaking Down the Market

To understand the 3D printing market comprehensively, it’s crucial to delve into its various segments. Here’s a breakdown of the key segments:

By Component

- Hardware: This segment includes 3D printers, scanners, and other related hardware. It holds the largest market share due to the high cost of 3D printing equipment.

- Software: 3D printing software is essential for designing, slicing, and preparing models for printing. This segment is expected to witness significant growth as software solutions become more sophisticated and user-friendly.

- Services: 3D printing services include on-demand printing, prototyping, and design services. This segment caters to businesses that may not have the resources or expertise to invest in their own 3D printing infrastructure.

By Printer Type

- Industrial 3D Printers: These printers are designed for high-volume production and are used in industries such as aerospace, automotive, and healthcare.

- Desktop 3D Printers: More affordable and compact, desktop 3D printers are popular among hobbyists, educators, and small businesses for prototyping and small-scale production.

By Technology

- Fused Deposition Modeling (FDM): The most widely used 3D printing technology, FDM, extrudes thermoplastic filament through a heated nozzle to build objects layer by layer.

- Stereolithography (SLA): SLA uses a UV laser to cure liquid resin, creating highly detailed and accurate models.

- Selective Laser Sintering (SLS): SLS uses a laser to fuse powdered material, such as nylon or metal, creating strong and durable parts.

- Digital Light Processing (DLP): Similar to SLA, DLP uses a projector to cure liquid resin, offering faster printing speeds for certain applications.

By Application

- Prototyping: 3D printing is widely used for rapid prototyping, allowing manufacturers to test and refine designs quickly.

- Tooling: 3D printing is used to create jigs, fixtures, and other tooling, reducing lead times and costs compared to traditional manufacturing methods.

- Functional Parts: Increasingly, 3D printing is used to manufacture end-use functional parts, particularly in industries with high customization needs.

By Vertical

- Automotive: The automotive industry is a major adopter of 3D printing for prototyping, tooling, and even limited-run production of customized parts.

- Aerospace & Defense: 3D printing is used to manufacture lightweight and complex components for aircraft and spacecraft, reducing weight and improving fuel efficiency.

- Healthcare: The healthcare industry leverages 3D printing for creating personalized medical devices, surgical guides, and even bioprinted tissues and organs.

- Education: 3D printing is transforming education by providing students with hands-on experience in design and manufacturing.

- Consumer Goods: From jewelry to footwear, 3D printing is enabling the creation of customized and personalized consumer products.

Regional Insights: 3D Printing Market by Geography

The 3D printing market exhibits distinct regional characteristics, influenced by factors such as:

- Government Support and Investments: Government initiatives and funding play a crucial role in driving 3D printing adoption.

- Industry Verticals: The presence of key industry verticals, such as automotive, aerospace, and healthcare, influences the demand for 3D printing solutions.

- Technological Infrastructure: Access to advanced technologies, research institutions, and a skilled workforce impacts the growth of the 3D printing market.

Here’s a regional overview:

North America: The Leading Force

- North America dominates the 3D printing market, driven by early adoption, strong government support, and the presence of major industry players.

- The United States, in particular, is a global leader in 3D printing innovation, with significant investments in research and development.

Europe: A Hub for Innovation

- Europe is another prominent region for 3D printing, with Germany leading the way.

- The region boasts a strong manufacturing base, particularly in the automotive and aerospace sectors, driving the demand for advanced 3D printing solutions.

Asia Pacific: The Fastest Growing Market

- The Asia Pacific region is projected to witness the fastest growth in the 3D printing market.

- Factors such as rapid industrialization, increasing government initiatives, and a growing manufacturing sector are fueling the demand for 3D printing in countries like China, Japan, and South Korea.

Rest of the World: Emerging Opportunities

- The rest of the world, including Latin America, the Middle East, and Africa, presents significant growth opportunities for the 3D printing market.

- As these regions experience economic growth and industrial development, the demand for 3D printing solutions is expected to increase.

Competitive Landscape: Key Players and Their Market Share

The 3D printing market is highly competitive, with a mix of established players and emerging startups vying for market share. Here are some of the key players shaping the industry:

1. Stratasys Ltd.

- Headquarters: Rehovot, Israel & Eden Prairie, Minnesota, U.S.

- Overview: Stratasys is a global leader in 3D printing solutions, offering a wide range of FDM and PolyJet 3D printers, materials, and software.

- Strengths: Strong brand recognition, extensive product portfolio, global reach, and a focus on innovation.

👉 Shop Stratasys on: Amazon | Stratasys Official Website

2. 3D Systems Corporation

- Headquarters: Rock Hill, South Carolina, U.S.

- Overview: 3D Systems is a pioneer in 3D printing, offering a comprehensive portfolio of 3D printers, materials, software, and services.

- Strengths: Broad range of technologies, including SLA, SLS, and metal 3D printing, strong presence in healthcare and industrial applications.

👉 Shop 3D Systems on: Amazon | 3D Systems Official Website

3. General Electric Company (GE Additive)

- Headquarters: Boston, Massachusetts, U.S.

- Overview: GE Additive is a subsidiary of General Electric, focusing on metal 3D printing technologies and solutions.

- Strengths: Expertise in metal additive manufacturing, strong presence in aerospace and industrial sectors, and a focus on large-scale production.

👉 Shop GE Additive on: GE Additive Official Website

4. HP Inc.

- Headquarters: Palo Alto, California, U.S.

- Overview: HP Inc. is a global technology leader that has entered the 3D printing market with its Multi Jet Fusion technology.

- Strengths: Focus on high-speed and high-volume production, expertise in inkjet technology, and a strong brand reputation.

👉 Shop HP 3D Printers on: Amazon | HP Official Website

5. EOS

- Headquarters: Krailling, Germany

- Overview: EOS is a leading supplier of industrial 3D printing solutions, specializing in metal and polymer technologies.

- Strengths: Expertise in laser sintering technologies, strong focus on research and development, and a global customer base.

👉 Shop EOS on: EOS Official Website

These key players, along with other notable companies, are continuously innovating and competing to capture a larger share of the rapidly growing 3D printing market.

Recent Innovations and Key Industry Developments

The 3D printing industry is a hotbed of innovation, with new breakthroughs and developments emerging regularly. Here are some recent innovations and key industry developments that are shaping the future of 3D printing:

- Advancements in Metal 3D Printing: Metal 3D printing technologies are rapidly advancing, with new materials, processes, and systems being developed. For instance, Desktop Metal’s Shop System and Production System are making metal 3D printing more accessible to a wider range of businesses.

- Bioprinting Breakthroughs: Researchers are making significant strides in bioprinting, with the development of bioinks that mimic the properties of human tissues and organs. Companies like Organovo and CELLINK are at the forefront of bioprinting research and development.

- Expansion of 4D Printing Applications: 4D printing, which involves creating objects that can change shape or properties over time, is finding applications in various fields. For example, MIT researchers have developed 4D printed materials that can be used to create self-assembling structures.

- Focus on Sustainability: The 3D printing industry is increasingly focusing on sustainability, with the development of eco-friendly materials and processes. For instance, some companies are using recycled plastics to create 3D printing filament.

- Industry Consolidation and Partnerships: The 3D printing industry is witnessing a trend of consolidation, with larger companies acquiring smaller players to expand their portfolios and market reach. Additionally, strategic partnerships are being formed to leverage complementary technologies and expertise.

Understanding the Report Coverage: What You Need to Know

When analyzing reports on the 3D printing market share by company, it’s essential to understand the scope and limitations of the data presented. Here are some key aspects to consider:

- Report Focus: Reports may focus on specific aspects of the market, such as 3D printer shipments, revenue generated, or material consumption. Ensure the report aligns with your specific information needs.

- Geographical Coverage: Reports may cover the global 3D printing market or focus on specific regions or countries. Verify the geographical scope to ensure it aligns with your areas of interest.

- Time Period: Reports typically provide data for a specific time period, such as a year or a forecast period. Pay attention to the time frame covered to ensure the information is relevant and up-to-date.

- Data Sources: Reports gather data from various sources, including industry surveys, company filings, and market research. Understand the data sources used to assess the reliability and accuracy of the information.

- Market Segmentation: Reports often segment the market based on factors such as component, printer type, technology, application, and vertical. Review the segmentation criteria to ensure it aligns with your analysis requirements.

By carefully considering these aspects, you can gain a more comprehensive and accurate understanding of the 3D printing market share by company and make informed decisions based on the insights provided.

Scope & Segmentation of the 3D Printing Market

The 3D printing market is vast and multifaceted, encompassing a wide range of technologies, materials, applications, and end-user industries. To make sense of this complex landscape, it’s crucial to understand the scope and segmentation of the market.

Scope

The scope of the 3D printing market encompasses all aspects related to the design, production, and application of three-dimensional objects using additive manufacturing technologies. This includes:

- 3D Printing Hardware: Printers, scanners, software, and other related equipment.

- Materials: Polymers, metals, ceramics, composites, and other printable materials.

- Software: Design software, slicing software, simulation software, and other software solutions.

- Services: On-demand printing, prototyping, design services, and other related services.

Segmentation

The 3D printing market can be segmented based on various factors, providing a more granular view of the industry. Key segmentation criteria include:

1. Component

- Hardware: This segment dominates the market due to the high cost of 3D printing equipment. It includes industrial-grade 3D printers, desktop 3D printers, 3D scanners, and related peripherals.

- Software: 3D printing software is essential for designing, slicing, and preparing models for printing. This segment is expected to grow significantly as software solutions become more sophisticated and user-friendly.

- Services: 3D printing services cater to businesses that may not have the resources or expertise to invest in their own 3D printing infrastructure. This segment includes on-demand printing, prototyping, design services, and consulting.

2. Printer Type

- Industrial 3D Printers: These printers are designed for high-volume production, offering high precision, speed, and a wider range of material compatibility. They are used in industries such as aerospace, automotive, and healthcare.

- Desktop 3D Printers: More affordable and compact, desktop 3D printers are popular among hobbyists, educators, and small businesses for prototyping and small-scale production.

3. Technology

- Fused Deposition Modeling (FDM): The most widely used 3D printing technology, FDM, extrudes thermoplastic filament through a heated nozzle to build objects layer by layer.

- Stereolithography (SLA): SLA uses a UV laser to cure liquid resin, creating highly detailed and accurate models.

- Selective Laser Sintering (SLS): SLS uses a laser to fuse powdered material, such as nylon or metal, creating strong and durable parts.

- Digital Light Processing (DLP): Similar to SLA, DLP uses a projector to cure liquid resin, offering faster printing speeds for certain applications.

- Other Technologies: Other emerging 3D printing technologies include Material Jetting, Binder Jetting, and Electron Beam Melting.

4. Application

- Prototyping: 3D printing is widely used for rapid prototyping, allowing manufacturers to test and refine designs quickly.

- Tooling: 3D printing is used to create jigs, fixtures, and other tooling, reducing lead times and costs compared to traditional manufacturing methods.

- Functional Parts: Increasingly, 3D printing is used to manufacture end-use functional parts, particularly in industries with high customization needs.

5. Vertical

- Automotive: The automotive industry is a major adopter of 3D printing for prototyping, tooling, and even limited-run production of customized parts.

- Aerospace & Defense: 3D printing is used to manufacture lightweight and complex components for aircraft and spacecraft, reducing weight and improving fuel efficiency.

- Healthcare: The healthcare industry leverages 3D printing for creating personalized medical devices, surgical guides, and even bioprinted tissues and organs.

- Education: 3D printing is transforming education by providing students with hands-on experience in design and manufacturing.

- Consumer Goods: From jewelry to footwear, 3D printing is enabling the creation of customized and personalized consumer products.

- Other Verticals: Other industries adopting 3D printing include architecture, construction, and energy.

Frequently Asked Questions: Your 3D Printing Queries Answered

Q1: What are the key factors driving the growth of the 3D printing market?

A: Several factors are driving the remarkable growth of the 3D printing market:

- Rapid Technological Advancements: Continuous innovation in 3D printing technologies, materials, and software is expanding the capabilities and applications of 3D printing, making it more accessible and versatile.

- Increasing Adoption Across Industries: Industries worldwide are increasingly integrating 3D printing into their workflows for prototyping, tooling, and even end-use part production, driven by its ability to accelerate product development cycles, reduce costs, and enable customization.

- Government Initiatives and Investments: Governments worldwide are recognizing the transformative potential of 3D printing and are investing in research and development initiatives to foster its growth and drive innovation in the field.

Q2: What are the major challenges hindering the wider adoption of 3D printing?

A: While 3D printing offers numerous benefits, some challenges hinder its wider adoption:

- Limited Material Selection: The range of materials compatible with 3D printing is still limited compared to traditional manufacturing processes, restricting some applications. However, ongoing research and development are constantly expanding the material palette available for 3D printing.

- Scalability and Mass Production: While 3D printing excels in prototyping and small-batch production, scaling up to mass production levels can be challenging and costly. However, advancements in 3D printing technologies and processes are addressing these challenges, making mass production more feasible.

- High Initial Investment Costs: The initial investment costs for 3D printers, materials, and software can be significant, posing a barrier to entry for some businesses, especially startups and SMEs. However, as 3D printing technology matures, costs are decreasing, making it more accessible to a wider range of users.

Q3: What are the future trends and opportunities in the 3D printing market?

A: The future of 3D printing is bright, with several exciting trends and opportunities on the horizon:

- Expansion into New Markets: 3D printing has the potential to revolutionize industries beyond manufacturing, such as healthcare, construction, and even food production. As 3D printing technology advances and costs decrease, its adoption in these sectors is expected to grow significantly.

- Development of New Materials: Research and development of new 3D printing materials with enhanced properties will unlock new applications and drive market growth. For example, the development of biocompatible materials is fueling the growth of bioprinting for medical applications.

- Integration with Industry 4.0: Integrating 3D printing with other Industry 4.0 technologies, such as AI, ML, and the Internet of Things (IoT), will lead to smarter and more efficient manufacturing processes. This integration will enable greater automation, customization, and optimization in 3D printing workflows.

- Sustainable Manufacturing: 3D printing can contribute to more sustainable manufacturing practices by reducing waste, minimizing material consumption, and enabling localized production. As sustainability becomes increasingly important, the 3D printing industry is focusing on developing eco-friendly materials and processes to minimize its environmental impact.

Q4: How can I find reliable market data and reports on the 3D printing industry?

A: Several reputable sources provide valuable market data and reports on the 3D printing industry. Some of the most trusted sources include:

- Market Research Firms: Leading market research firms such as Gartner, IDC, and Forrester Research publish comprehensive reports on the 3D printing market, providing insights into market trends, growth drivers, challenges, and competitive landscapes.

- Industry Associations: Industry associations such as the Additive Manufacturer’s Green Trade Association (AMGTA) and the 3D Printing Industry Association (3DPIA) offer valuable resources, including market data, industry news, and events.

- Government Agencies: Government agencies such as the National Institute of Standards and Technology (NIST) in the United States and the European Commission publish reports and studies on the 3D printing industry, providing insights into policy initiatives, research and development, and market trends.

Q5: What are some tips for choosing the right 3D printer for my needs?

A: Choosing the right 3D printer depends on your specific requirements and budget. Here are some tips to help you make an informed decision:

- Determine Your Needs: Consider the types of objects you want to print, the required print quality, the materials you need to use, and your budget.

- Research Different Technologies: Familiarize yourself with the different 3D printing technologies available, such as FDM, SLA, SLS, and DLP, and understand their strengths and limitations.

- Read Reviews and Compare Models: Read online reviews from other users and compare different 3D printer models based on factors such as print quality, speed, reliability, and ease of use.

- Consider After-Sales Support: Choose a reputable 3D printer manufacturer that offers good after-sales support, including technical assistance, warranty, and access to spare parts.

By following these tips, you can choose a 3D printer that meets your specific needs and budget, allowing you to explore the exciting world of 3D printing.

Conclusion: The Future of 3D Printing Market Share

As we wrap up our deep dive into the 3D printing market share by company, it’s clear that this industry is on an exhilarating trajectory. With a projected market value soaring to USD 101.74 billion by 2032 and a robust CAGR of 23.4%, the opportunities are vast and varied. The key players like Stratasys, 3D Systems, and GE Additive are not just leading the charge; they are continually innovating to stay ahead in this competitive landscape.

Key Takeaways

- Positives: The rapid advancements in technology, increasing adoption across various industries, and the push for customization and sustainability are driving the market forward. Companies are leveraging 3D printing for everything from prototyping to end-use parts, making it a versatile tool in modern manufacturing.

- Negatives: However, challenges such as high initial costs, limited material options, and scalability issues remain hurdles that need addressing. The market is still maturing, and businesses must navigate these challenges wisely.

In conclusion, if you’re considering diving into the world of 3D printing—whether for personal projects, educational purposes, or industrial applications—now is the time! The technology is becoming more accessible, and the potential for creativity and innovation is boundless.

Confident Recommendation

We confidently recommend exploring established brands like Stratasys and 3D Systems for industrial applications, while Creality and Anycubic are fantastic options for hobbyists and educators. With the right printer, you can unlock a world of possibilities!

Recommended Links for Further Exploration

- 👉 Shop Stratasys on: Amazon | Stratasys Official Website

- 👉 Shop 3D Systems on: Amazon | 3D Systems Official Website

- 👉 Shop GE Additive on: GE Additive Official Website

- Explore 3D Printing Innovations: 3D Printing Innovations

- Books on 3D Printing: 3D Printing: The Next Industrial Revolution | 3D Printing for Dummies

FAQ: Your 3D Printing Questions Answered

What are the top 3D printing companies in the market?

Top Players

- Stratasys Ltd. – A pioneer in FDM technology, known for its extensive range of 3D printers and materials.

- 3D Systems Corporation – Renowned for its diverse technologies, including SLA and SLS, catering to various industries.

- GE Additive – Focused on metal additive manufacturing, particularly in aerospace and industrial applications.

- HP Inc. – Known for its Multi Jet Fusion technology, which emphasizes speed and efficiency in production.

- EOS GmbH – Specializes in industrial 3D printing solutions, particularly for metal and polymer applications.

Read more about “Top 10 3D Printing Market Leaders You Need to Know in 2025 🚀”

How is the 3D printing industry expected to grow in the next 5 years?

Growth Projections

The 3D printing industry is expected to experience significant growth, with projections indicating a CAGR of around 21.2% to 23.5% over the next five years. This growth is driven by increasing demand for rapid prototyping, customization, and advancements in materials and technologies. Industries such as healthcare, automotive, and aerospace are particularly poised for growth as they adopt 3D printing for various applications.

What is the current market share of major 3D printing companies like Stratasys and 3D Systems?

Market Share Insights

As of recent reports, Stratasys and 3D Systems are among the top players in the 3D printing market, with Stratasys holding approximately 15% of the global market share, while 3D Systems follows closely behind. The competitive landscape is dynamic, with companies continuously innovating to capture a larger share of the market.

Which companies are leading in the desktop 3D printing market share?

Desktop Market Leaders

In the desktop 3D printing segment, companies like Creality, Anycubic, and Prusa Research are leading the charge. These brands are popular among hobbyists and educators due to their affordability, user-friendly designs, and community support. Creality’s Ender series and Prusa’s i3 models are particularly well-regarded for their performance and reliability.

Read more about “The 10 Key Insights on 3D Printing Market Share You Need to Know! 🚀 …”

What are the key trends shaping the 3D printing market and its future outlook?

Emerging Trends

Key trends include:

- Generative Design: Leveraging AI to create optimized designs.

- Bioprinting: Advancements in creating tissues and organs for medical applications.

- Sustainability: Focus on eco-friendly materials and processes.

- 4D Printing: Materials that change shape over time in response to stimuli.

These trends indicate a shift towards more innovative and sustainable practices in the industry.

How do companies like MarkForged and Carbon dominate the industrial 3D printing market share?

Market Dominance

MarkForged and Carbon have carved out significant niches in the industrial 3D printing market by focusing on high-performance materials and advanced technologies. MarkForged specializes in composite materials, allowing for strong and lightweight parts, while Carbon’s Digital Light Synthesis technology enables high-speed production of high-quality parts. Their focus on industrial applications and partnerships with major manufacturers has solidified their positions in the market.

What are the emerging players in the 3D printing market and their potential impact on the industry?

Emerging Innovators

Emerging players like Formlabs, Sinterit, and Xometry are making waves in the 3D printing market. Formlabs is known for its high-quality SLA printers, while Sinterit specializes in SLS technology for small-scale production. Xometry offers on-demand manufacturing services, connecting customers with a network of manufacturers. These companies are pushing the boundaries of innovation and could significantly impact the market by introducing new technologies and business models.

Reference Links

- Fortune Business Insights – 3D Printing Market

- Grand View Research – 3D Printing Industry Analysis

- Market.us – 3D Printing Market Size, Share, Trends | CAGR of 21.2%

- 3D Systems Official Website

- Stratasys Official Website

- GE Additive Official Website

- HP Official Website

- EOS Official Website

With these insights, you’re now equipped to navigate the exciting world of 3D printing! Whether you’re a hobbyist, educator, or industry professional, the possibilities are endless. Happy printing! 🎉